Adulting with Marty

This event featured a topic that you’ve all been asking for. We brought in our friend and expert Marty Staniforth of Staniforth Real Estate to discuss that elusive adulting goal of buying real estate! Marty has carved out a niche helping first-time buyers.

We discussed things like:

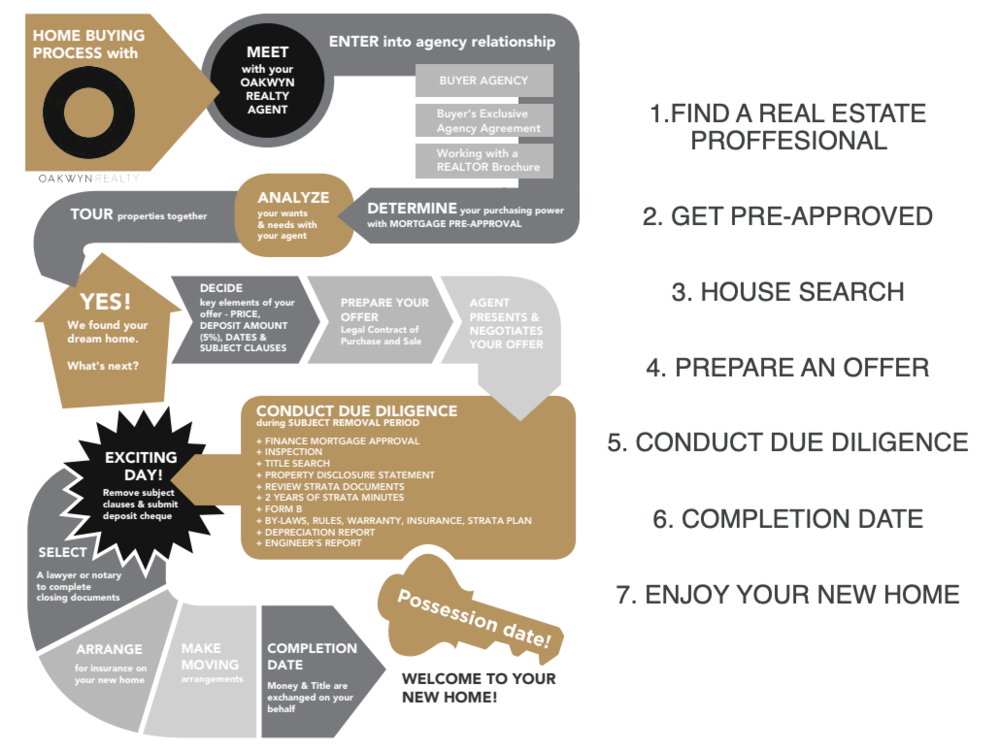

- The steps to take when considering buying your first property

- What specifics Marty would have us consider when working with a real estate professional

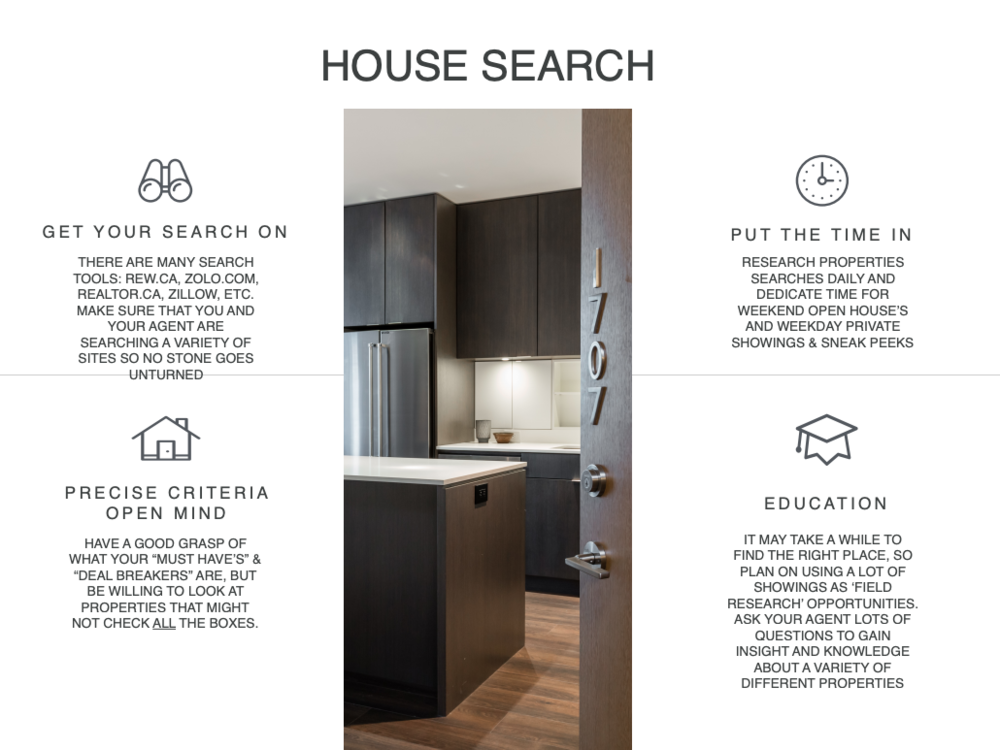

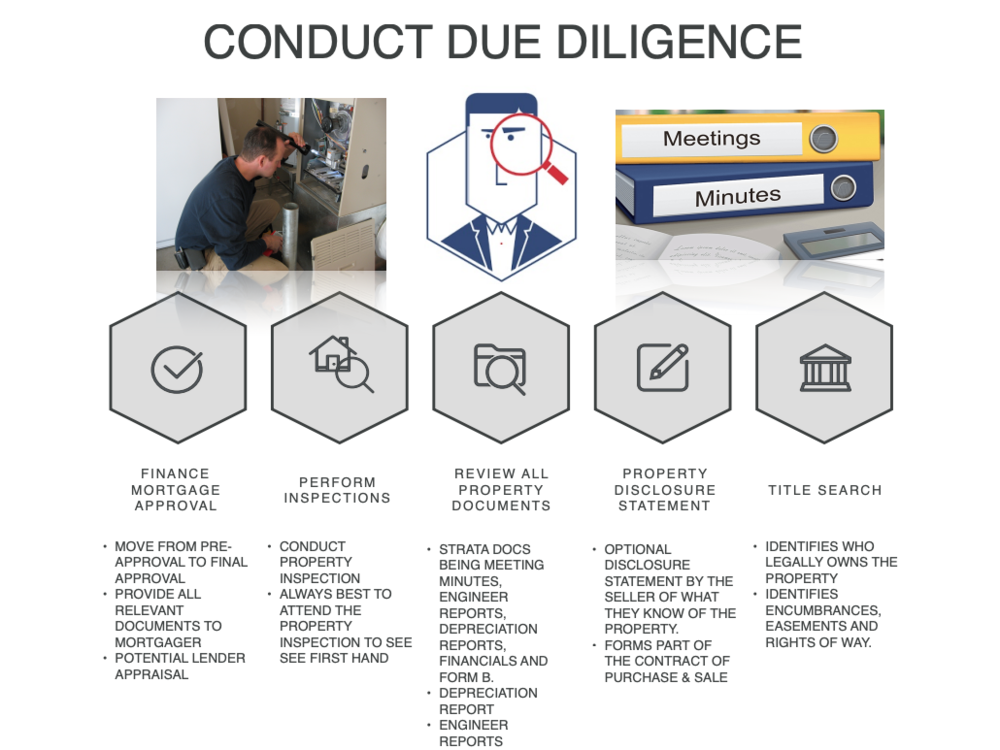

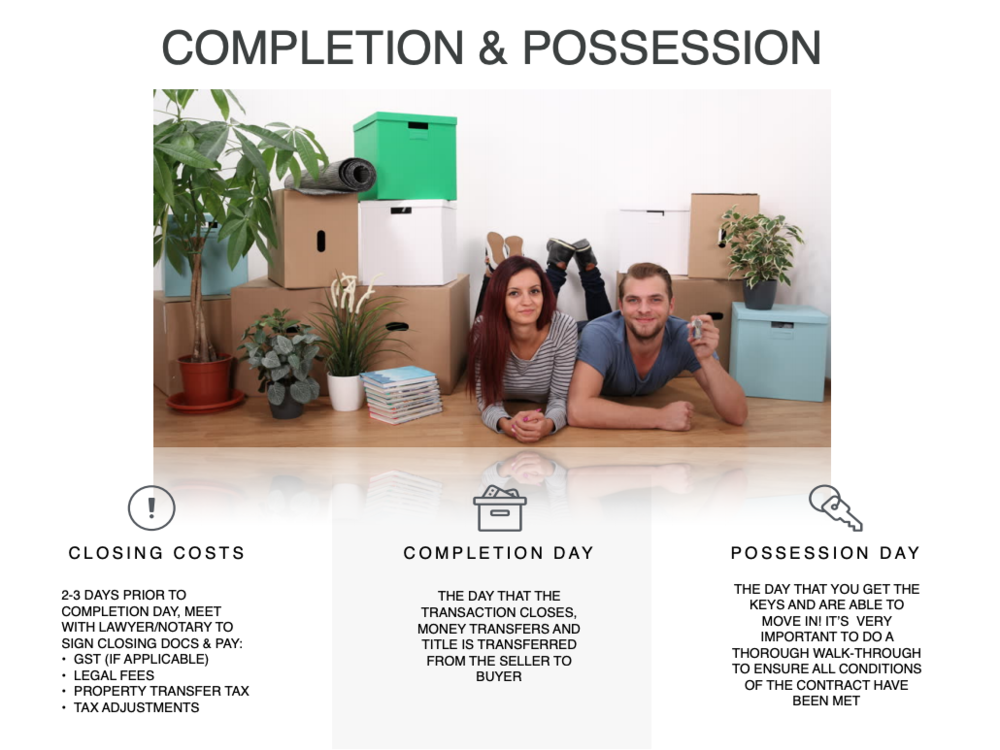

- Interesting pieces of overall guidance from Marty on the search, offer, and acquisition process, along with some thought-provoking tips & quotes

As a bonus, you’ll find photos from the event below!

Marty’s Adulting Advice

Some good questions to ask a potential real estate professional:

-

How long have you been in Real Estate?

-

What do you enjoy most about your job?

-

What gives you an advantage over other agents?

-

How much capacity do you have right now to take on a new client?

-

Can you walk me through the home buying process?

First-Time Homebuyers Program At-a Glance

The First-Time Homebuyers’ Program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. If you qualify for the program, you may be eligible for either a full or partial exemption for the tax.

Do I qualify?

To qualify for a full exemption, at the time the property is purchased you must:

- Be a Canadian citizen or a permanent resident

- Have lived in B.C. for 12 consecutive months immediately before the date you register the property or filed at least 2 income tax returns as a B.C. resident in the last 6 years

- Have never owned an interest in a principal residence anywhere in the world at any time

- Have never received a First-Time Homebuyers’ exemptions or refund

The property must:

-

Be located in BC

-

Only be used as your principle residence

-

Have a fair market value of $475,000 or less if registered on or before February 21, 2017, OR $500,000 or less if registered on or after February 22, 2017

-

Be 0.5 hectares (1.24 acres) or smaller

You may qualify for a partial exemption from the tax if the property:

-

Has a fair market value less than $500,000 if registered on or before February 21, 2017, OR $525,000 if registered on or after February 22, 2017.

-

Is larger than 0.5 hectares

-

Has another building on the property other than the principle residence