Most people aren’t!

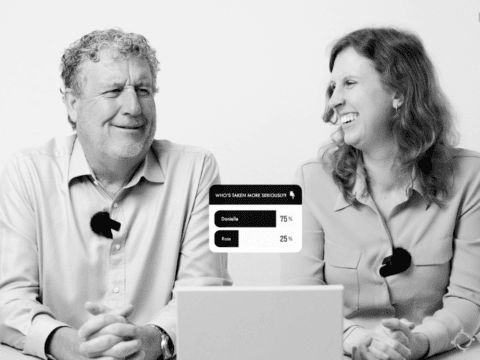

If you’re resisting thinking about inheritance, you’re certainly not alone. A recent study discovered that more than half of Canadians haven’t even discussed inheritance with their family members, let alone how taxes might apply to them. And while 59% of Canadians anticipate receiving some kind of inheritance, only 33% have a good understanding of the tax implications.

While it might save you from having some sensitive conversations with your family, a passive approach to inheritance planning can have hard financial consequences (either for you, or for them) during what’s already an incredibly difficult time.

In Canada, when a person dies, their estate (in most provinces) goes through a process called probate. Basically, everything we own gets taxed, and that tax has to be paid before anyone can receive anything we leave to them.

There are lots of strategies people can take to reduce the tax burden their beneficiaries will face after they’re gone; like maximizing TFSAs, setting up trusts, and gifting while they’re still alive. But a particularly useful tool is – perhaps you guessed it – life insurance.

Life insurance is separate from a will and can also be separate from an estate. It pays out tax-free directly to the beneficiaries that are named. This makes it a smart way to transfer wealth without anyone having to pay a huge tax bill.

For a deeper dive into all the details around inheritance and tax, check out the study mentioned above. And to learn about how life insurance might provide an inheritance planning solution for you, come talk to us!