Adulting with Julia

We were excited to finish off our series with financial planner Julia Chung, who workshopped how to set financial goals based on our own unique values and priorities.

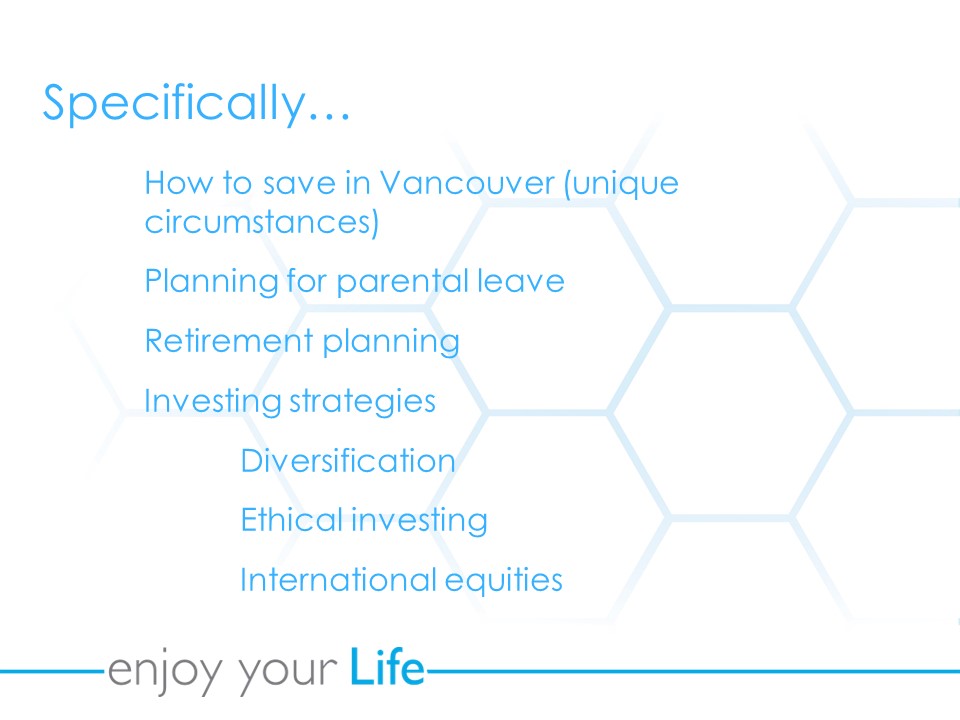

We discussed things like:

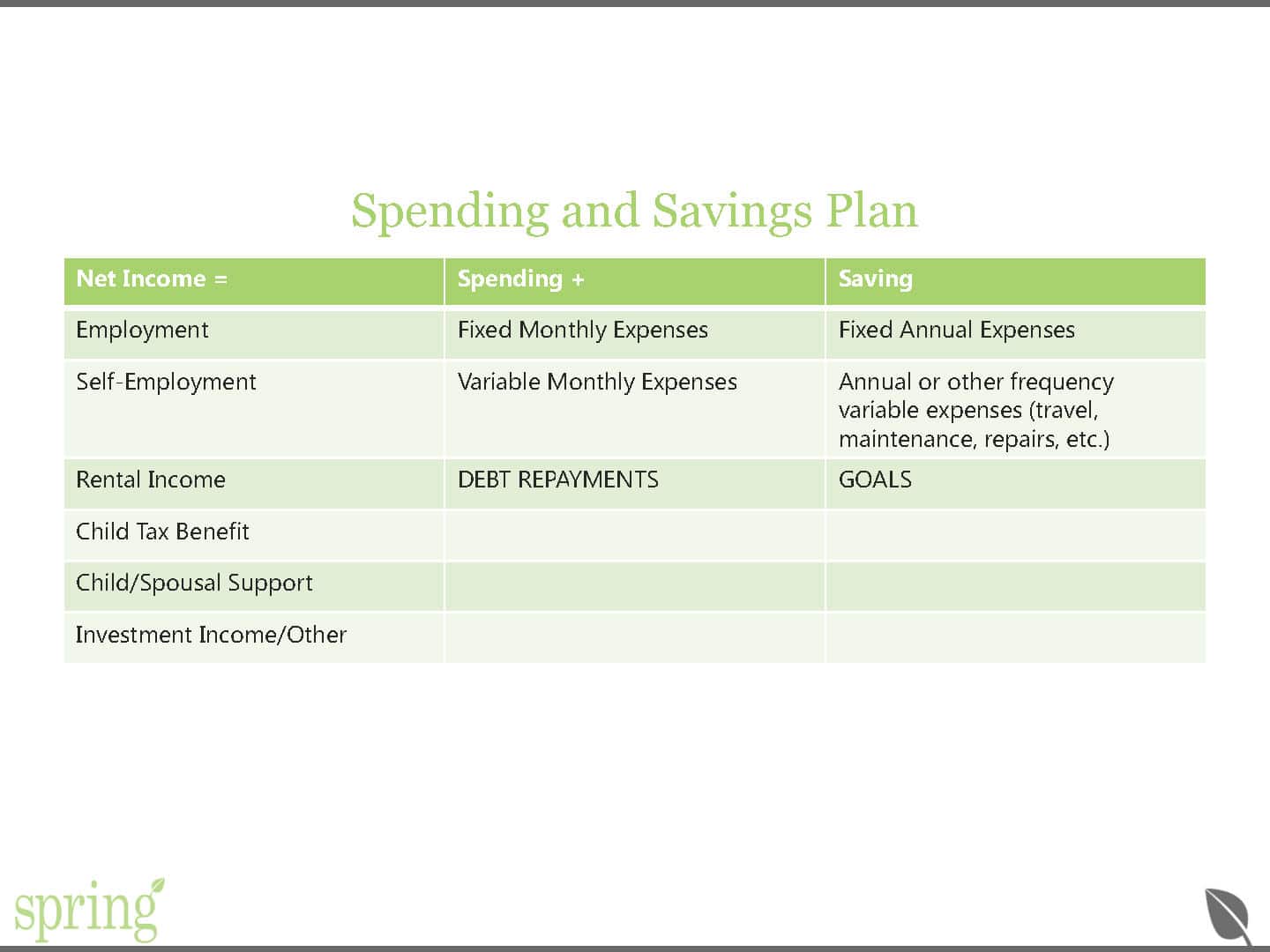

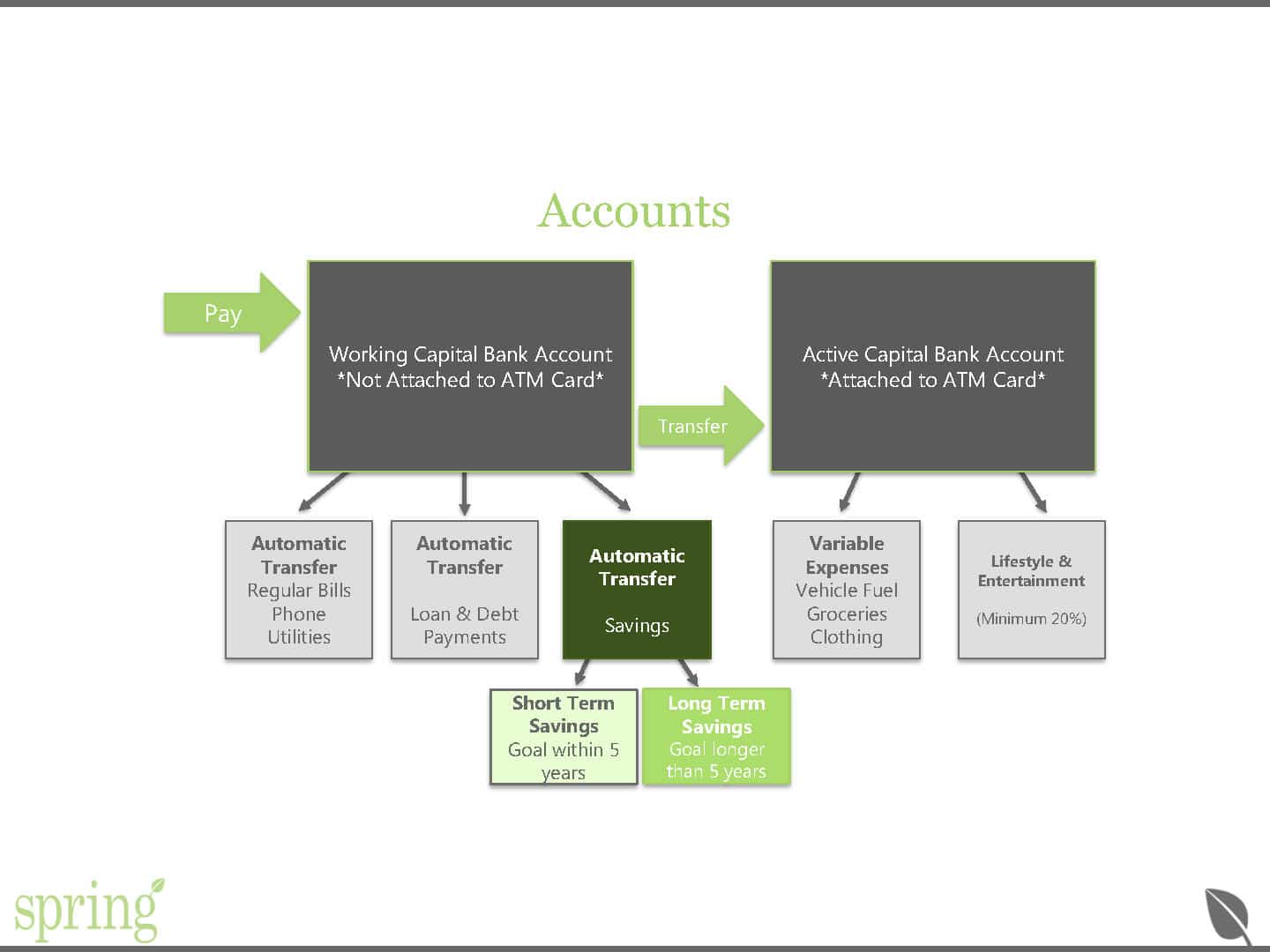

- Differences between a scarcity mindset (budgeting) and a growth mindset (cashflow planning)

- How to be conscientious with spending and counteract forces that contribute to overspending and shame

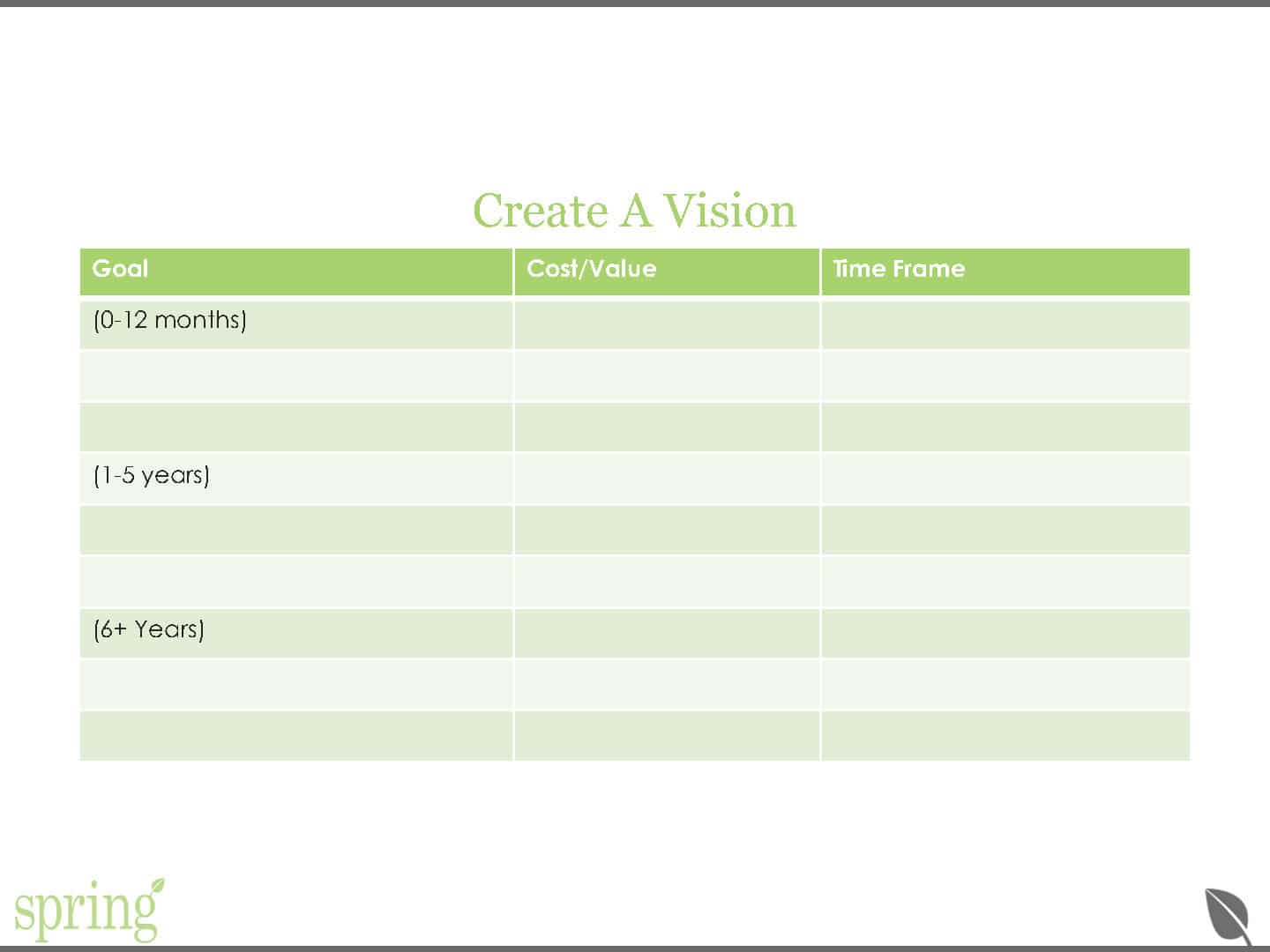

- Goal setting and aligning our cashflow with those goals

More photos from the event are below!

Julia’s Adulting Advice

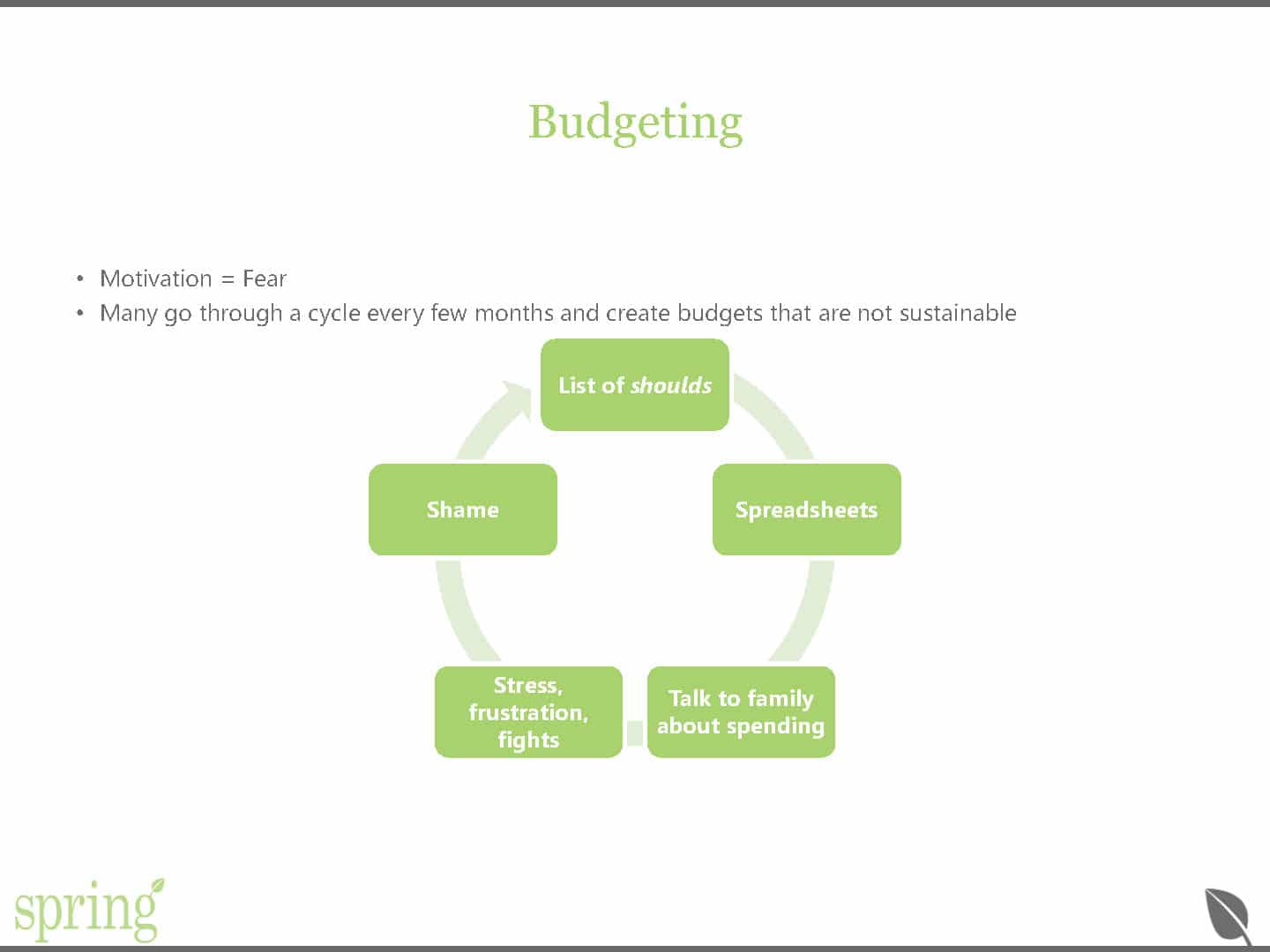

Julia taught us that budgets are usually fear-based: we create them when we feel we don’t have enough. This can lead to an unsustainable or unrealistic allocation of our financial resources.

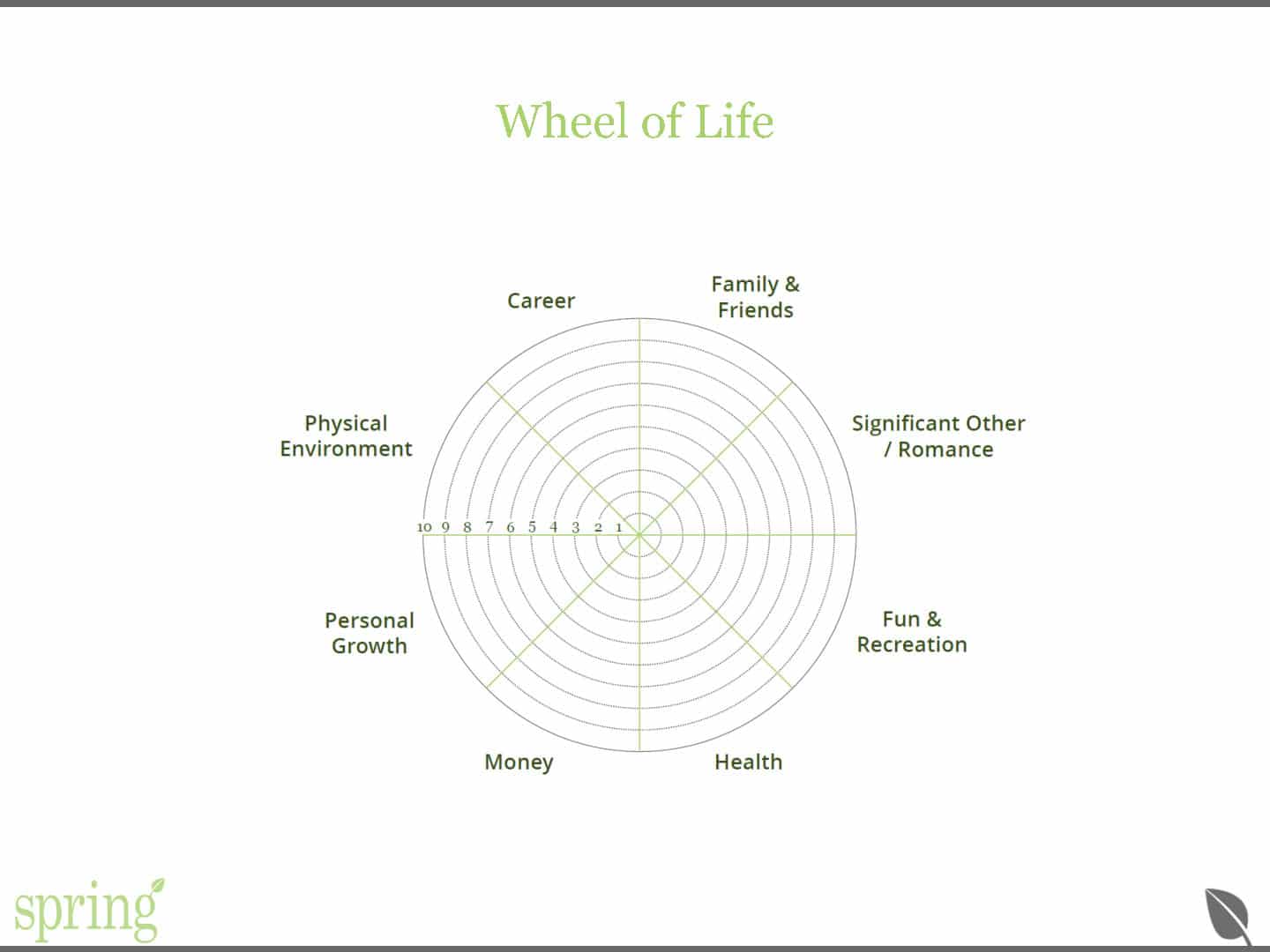

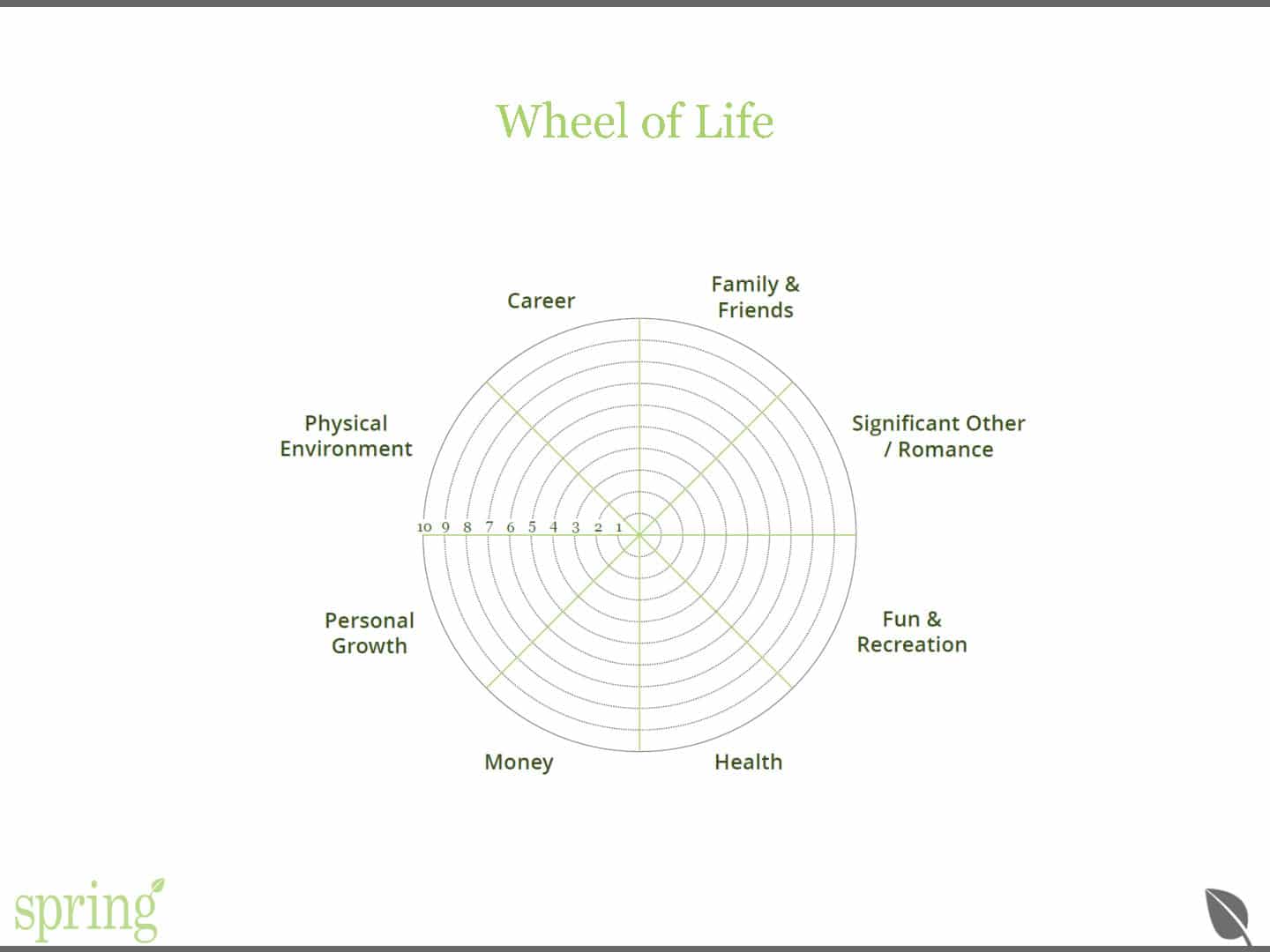

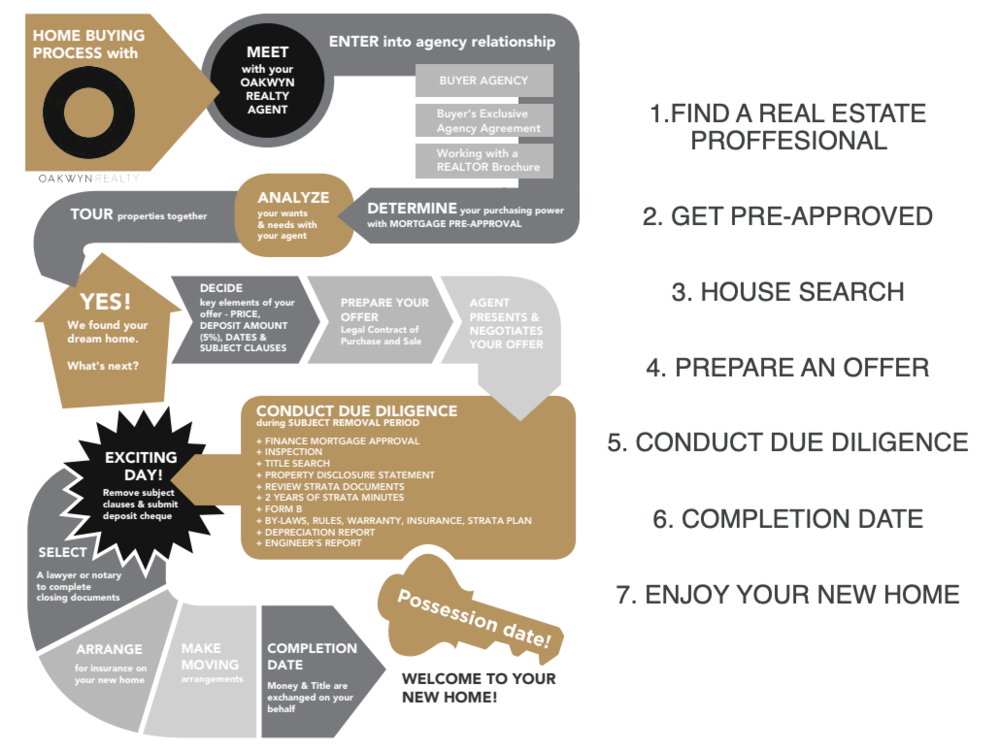

She advises to start your financial planning by filling out your ‘wheel of life.’ From there, prioritize areas you’d most like to improve, figure out what the gaps are between where you are now and where you’d like to be, and then set specific goals. This approach aligns your finances with your values, and this synergy is motivating!

We also learned that “should” is a swear word. If you’re saving for something because you think you should, you won’t be motivated.

Take the time to outline the specifics of your financial goals. “I save enough to take a vacation somewhere warm next year” isn’t as exciting as “I learn to surf in Sámara, Costa Rica in Winter 2020.” Experts recommend that at least 20% of your after-tax income be spent on lifestyle and entertainment, allowing you to enjoy your life.

Keeping focused on your financial goals is difficult – our culture promotes mindless consumption and it’s hard to work against this system. Goal-setting and being a thoughtful consumer are two tools we can use in response.

There’s no one-size-fits-all solution to finances. There isn’t one way to invest, one set percentage to put aside for retirement. The answer starts with you putting in the work to determine what your values and goals are.

“It doesn’t matter what you make, it’s what you keep.”

“It doesn’t matter what you make, it’s what you keep.”