Why would I need life insurance?

Life insurance helps take financial care of your family, loved ones, or even your business if something happens to you. If you have a mortgage, income that would need to be replaced, or taxes that would need to be paid, it can offer a solution.

How much does it cost?

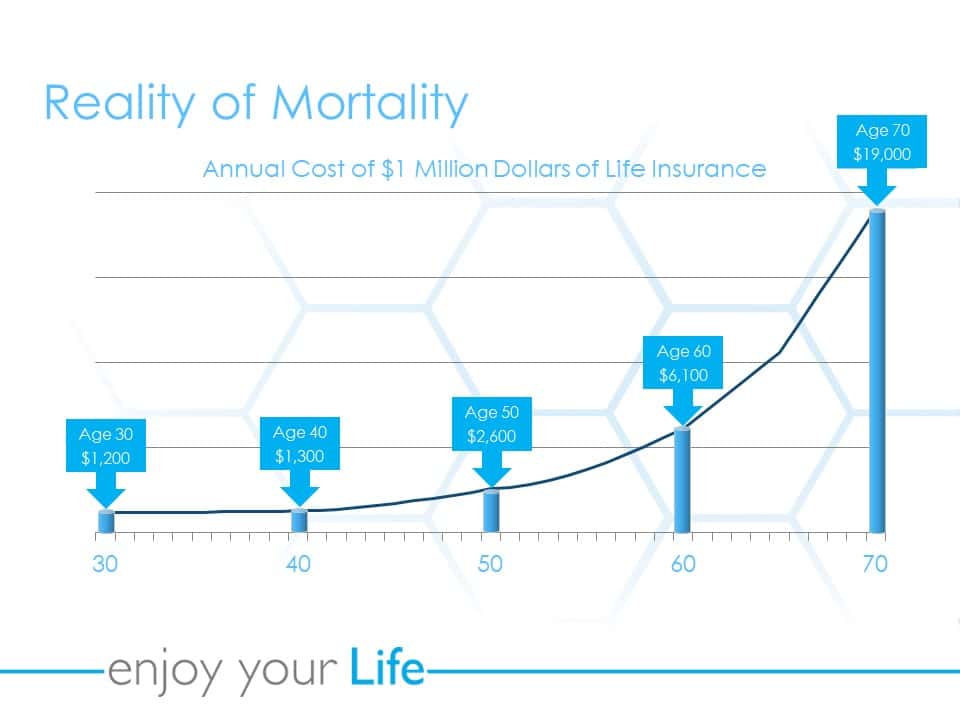

The life insurance companies determine your cost based on your age, gender, and health. It also depends on how much insurance you want, and what type of life insurance you get. Your insurance payments are called “premiums” and are usually paid monthly or annually.

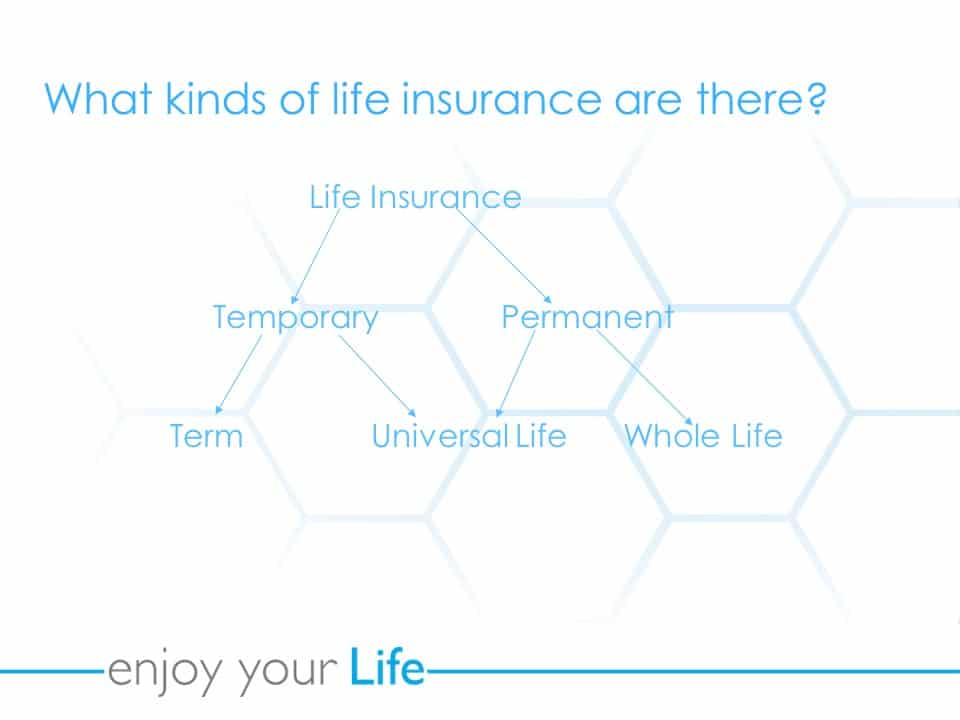

What’s the best type of life insurance to get?

Each type of life insurance has its pros and cons. In Canada we have 2 main types: “term” and “permanent.” Here’s a brief summary their differences:

Term Insurance

- Term insures you for a set period of time. For example: years left on your mortgage, until you retire, or until your kids are no longer financially dependent on you.

- If you want to renew your insurance after the term expires, your premiums increase, sometimes by an exponential amount. This can be problematic if you need the insurance longer than you originally anticipated.

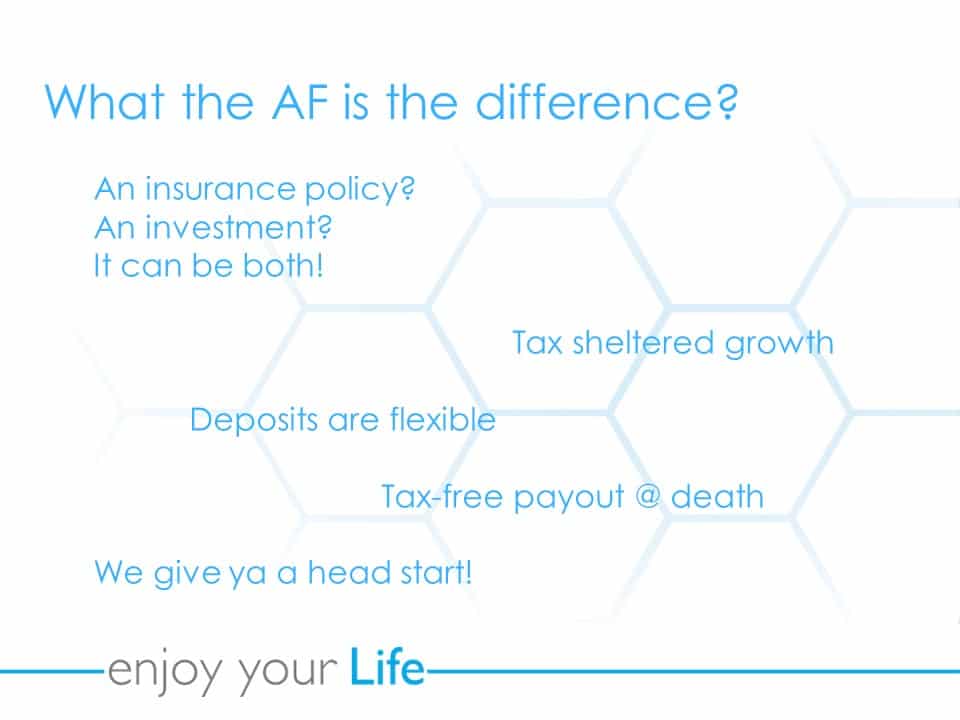

- Unlike permanent insurance, there’s no opportunity with term insurance to pre-pay, or to have an account inside your policy you can pay into to create additional value.

- Term insurance is the simplest life insurance product. Permanent insurance is a little more complicated, but offers additional flexibility and financial benefit to you.

Permanent Insurance

- The term of a permanent insurance policy never expires.

- When you apply, you have the option to pre-pay for several years’ worth of insurance.

- If you stop paying your premiums, you may still be insured under your policy if you’ve paid enough money into it already. This is because a permanent policy has an account inside of it where your money can grow.

- There are actually three kinds of permanent insurance: “universal life,” “non-participating whole life,” and “participating whole life.” If you really want to get into the nitty gritty, we’re happy to chat.

The important thing to know is that universal life offers both flexibility and financial benefit at a lower cost.

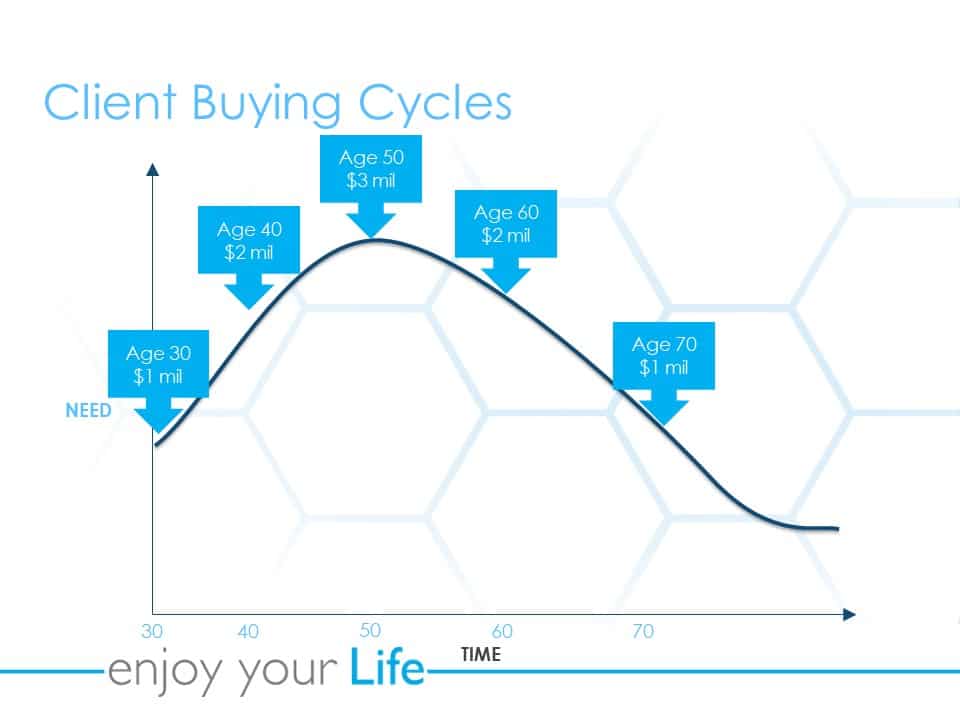

How much do I need?

It depends! We’ll work with you to recommend an amount and price point customized to your situation.

What is Allan Financial’s role?

We work with several life insurance companies — Sun Life, Manulife, Canada Life, RBC, ivari, beneva, Industrial Alliance, Specialty Life Insurance, and BMO. They all have different products and pricing structures so we get to choose what works best for you! Our role is to advise you, represent your best interests, and make the process as easy as possible.

How does Allan Financial get paid?

We get paid a commission by the insurance company. Sometimes, we’ll use a portion of our commission to make your life insurance more affordable. Ask us for more details!

How do I get started?