We raise a glass to two new team members that have arrived to champion analysis and client care. Emily interviews communications consultant Holly Graff, and product design/finance associate Dania Clarke.

Why here?

Dania: AF as a whole left a striking impression on me. What I saw was an energetic, cohesive, high-performance team advocating for clients and challenging the status quo of a longstanding industry. I thought insurance would be boring…I was wrong.

Holly: Yeah, I’m constantly amazed that Allan Financial actually makes life insurance exciting! Plus, where else could I combine my nerdy research and writing skills with the opportunity to make a difference in people’s lives?

Why now?

Holly: After a decade of having Ross tilt his head and say, “we’re gonna work together one day” during our client meetings, he finally got his wish! Seriously though, we have a shared entrepreneurial spirit, and it just took both of our career points to align at the same time.

Dania: I’m at a point in my career where I’m ready to be part of a team like this – young, vibrant, motivated, streamlined, yet having a big financial impact. Allan Financial is the right place at the right time for me.

What have you been up to?

Holly: Well, for one, I’ve launched the Bowen Innovation Series. It’s a 4-part series of gatherings for business leaders and change agents living on Bowen. There are so many amazingly talented folks doing incredible things, who often don’t have the chance to venture outside their own circles. And then to have the chance to be the straw that stirs that drink is an opportunity just too good to pass up.

So between Ross and I (and Patti-Jo, Danielle, and Emily) knowing a pretty good chunk of the island, I realized that Allan Financial was in a unique position to foster these connections, and nurture innovative ideas outside of our own business, all for the benefit of our shared community.

Dania: My role couldn’t be much more different than Holly’s! I spend most of my day maneuvering numbers. I customize policies for each person we serve because each person has a unique set of needs and goals. The magic is in the details.

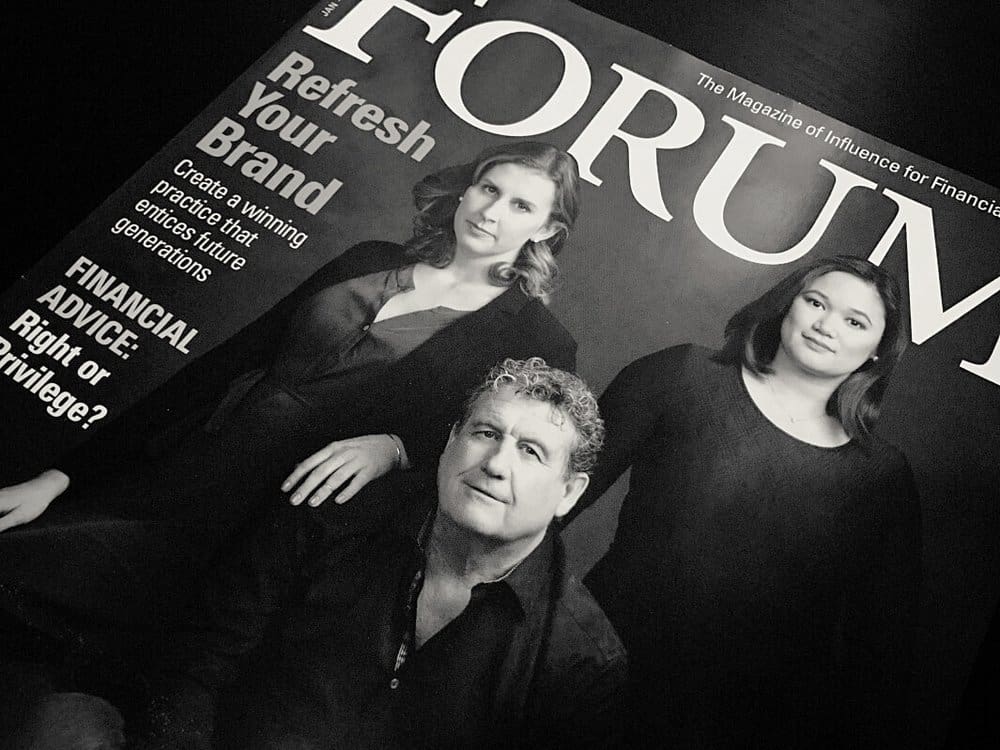

I also get to spend time with Ross, the man himself, listening and synthesizing his unique insurance offerings into rows and columns. This is in support of Chriselle, our Director of Product Design, who has taken me under her wing. I also get to witness the intergenerational relationship between Ross and his daughter Danielle, our Finance Director. Their communication tends to transcend words… it’s pretty fun to watch.

At what moment did you know you were not working at a regular insurance company?

Dania: I knew from the moment I walked in the door. Everything here challenges convention, from the architecture of the office space to the diverse talents of the team. We innovate because innovation is modelled to us daily. There is room to fail, dust ourselves off, and try again. That’s rare.

Holly: I know most of the team, having been a client and friend for years. I knew exactly what I was getting into (well, sort of…). It’s common knowledge that Ross hires people first, and builds positions around their strengths. Most of my work has been in partnership with academics and senior business leaders in the US. I’m a writer, a communicator, and a community builder. I’m here to build bridges.

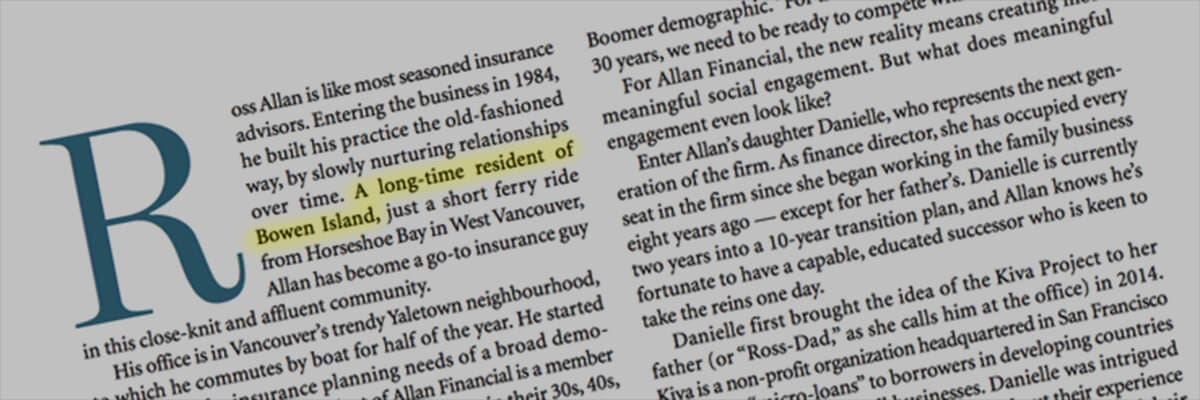

Like many other Bowen folk, I’ve marvelled at how Allan Financial thrives in both worlds – the island and the city. Not many have crossed the pond and maintained deep island roots quite as successfully as Ross. Allan Financial is considered a national leader in financial services, but still feels grassroots. I love that.