Bowfest 2019!

Our community of Bowen Island comes together at the end of every summer to put on the annual community festival, aptly named “Bowfest.” We have participated for more than a decade now, by sponsoring and volunteering to man the rides. This year, we were responsible for the inflatable Bungee Run that had kids straining to race against one another.

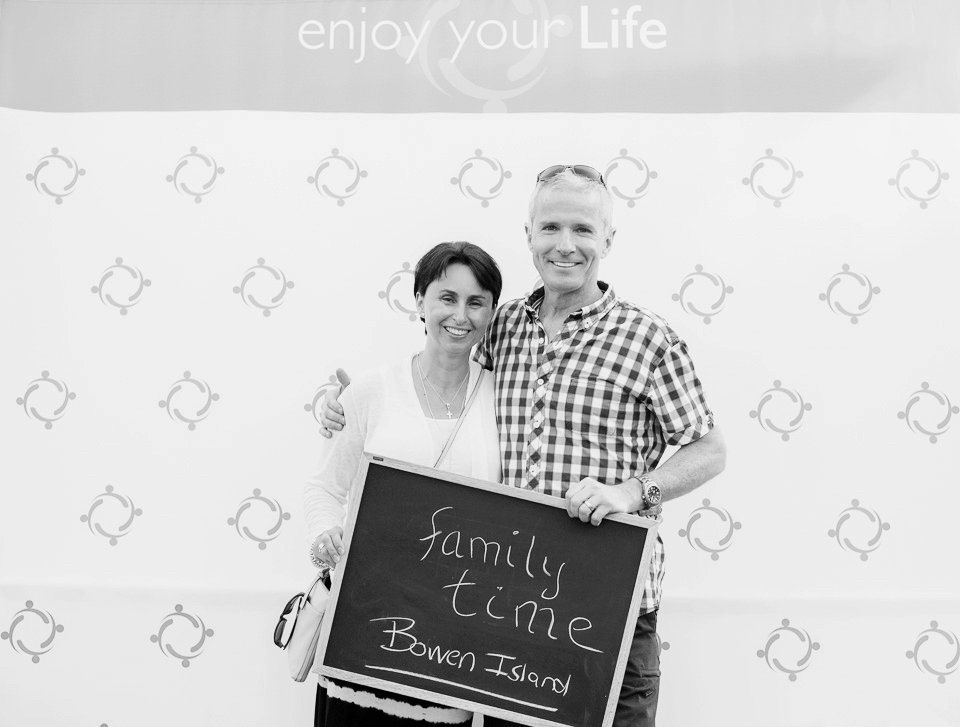

Giving out our signature Enjoy Your Life t-shirts celebrating each years event, and spotting these around the lower Mainland throughout the year has become a tradition for a generation of Bowen Islander, big and small. We would LOVE to get tagged if you see one of these t-shirts out and about. On facebook we are @allanfinancial and on instagram we are @enjoyyourlife.af

If you were there you know all about it, but if not, you can tell from the photos that we had a blast catching up with friends and clients all day long!

Always growing and stretching into change, just like our clients!

Always growing and stretching into change, just like our clients!